Turkey Real Estate Prices: The 2026 Reality Check for Buyers

Table of Contents

Forget the rulebook from three years ago. The Turkish real estate market hasn’t just changed; it has mutated. The days when you could snap up a luxury apartment with a sea view for €50,000 are history. However, Turkey remains one of the most dynamic markets globallyif you know exactly where to look and what to ignore.

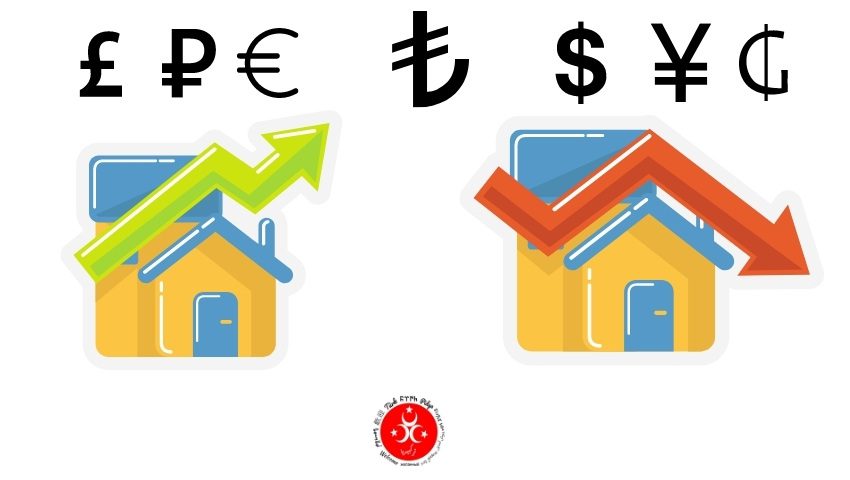

As we head into 2026, housing prices are no longer driven solely by supply and demand. They are heavily manipulated by local inflation and the volatility of the Lira. This creates a paradox for foreign buyers holding Dollars or Euros: while prices in Lira are exploding, values in hard currency are stabilizing or, in some luxury segments, even softening.

Market Update 2026: The “Real” Price Tag

Let’s be brutally honest. Asking for the “average price” of a home in Turkey is as useful as asking for the average temperature in the United States. The market is deeply fractured. Below are the realistic price per-square meter costs you need to budget for in the major hubs right now:

- Istanbul: The heartbeat of the market. Expect an average of $1,630 (approx. €1,500) per m². But here is the street reality: In prime districts like Beşiktaş or Kadıköy, you will pay 80,000–200,000 TRY per m². Meanwhile, outskirts like Esenyurt offer significantly lower entry points, though with higher risk.

- Antalya: The hotspot for holiday homes. Prices here have surged, driven by aggressive international demand. The average now sits around $1,198 (approx. €1,100) per m².

- Izmir: The modern Aegean alternative. Prices are hovering around $1,135 (approx. €1,050) per m².

- Ankara: The capital remains the practical choice. At roughly $920 (approx. €850) per m², it often offers the best value for-money if you are buying for residential utility rather than tourism speculation.

Practitioner Tip: Never judge a property by the price tag alone. Infrastructure dictates resale value. A luxury condo in Istanbul without rail access is a nightmare to commute from and harder to rent out. Before you commit, study the local grid carefully. Our guide to transportation in Istanbul breaks down exactly which metro lines drive property value.

The Factors Agents Won’t Mention

The price on the glossy brochure is only half the story. If you are serious about buying in Turkey, you need to understand the invisible dynamics that eat into your ROI:

1. The Inflation Trap

Nominal prices in Turkish Lira (TRY) have been rising by approximately 30-33% annually. On paper, that looks like a fantastic return. However, with consumer inflation still above 50%, your real (inflation-adjusted) gain is effectively zero or even slightly negative. This is where the economic landscape gets tricky. Your advantage as a foreign buyer is holding hard currency (USD/EUR), which insulates you from the Lira’s daily devaluation. Invest for the long haul, not for a quick flip.

2. The Earthquake Premium

Since the tragic events of 2023, the market psychology has shifted permanently. New builds compliant with the latest seismic regulations command a massive premium. Older buildings (pre-2000), once prized for their central locations, are now viewed with suspicion. Always demand the geological survey report (Zemin Etüdü) and the building year. If the seller hesitates, walk away.

3. The Citizenship Appraisal Gap

You will see many properties priced suspiciously close to $400,000. This isn’t a coincidence; it is the threshold for Turkish Citizenship by Investment. But here is the trap: The official appraisal report (Ekspertiz Raporu) must match the sales price. If the government appointed appraiser values the home at $380,000, your application for citizenship will be rejected, even if you paid the full $400,000. Ensure the valuation is guaranteed before you sign.

Which Layouts Actually Resell?

Not every apartment type works in every city. Here is the street smart breakdown:

- 1+1 (One Bedroom): The rental king of Istanbul. Ideal for students, expats, and short-term rentals. However, in holiday zones like Antalya, these are often less desirable than larger family units.

- 3+1 or 4+1 (Family Units): The safest bet in Ankara or Izmir. Turkish families rent long-term and prioritize space. Notably, Ankara is currently the only major city showing positive real price growth.

- Penthouses & Duplexes: Often marketed as luxury, but check the roof insulation personally. In Antalya’s scorching summers or Ankara’s freezing winters, a poorly insulated roof will cause your energy bills to skyrocket. Also note that coastal luxury markets like Muğla (Bodrum) average around $2,042 per m² but are growing more slowly at +9.7% YoY.

Hidden Costs: Avoiding the Sticker Shock

Calculate an extra 5-8% on top of the purchase price for closing costs. Most online calculators conveniently ignore these:

- Title Deed Tax (Tapu Fee): 4% of the declared value. Legally, this should be split between buyer and seller. In reality? Sellers often push the entire 4% onto the foreign buyer. Negotiate this upfront.

- VAT (KDV): Ranges from 1% to 20% depending on net square meterage. Foreigners can sometimes claim an exemption if bringing foreign currency into the countryspeak to a tax specialist.

- Notary & Translation: Do not underestimate this. You will need sworn translators and notarized documents for every step. It’s a bureaucracy heavy process, similar to the paperwork involved in finding a job in Turkey as an expat.

The Right Time to Visit

One final practical tip: Plan your viewing trip strategically. During religious holidays, the country slows down, and government offices (essential for title deed transfers!) are closed. Before booking your flight, check the dates for Eid al Fitr and other public holidays to ensure you don’t end up standing in front of locked doors.

The Turkish real estate market in 2026 isn’t easy money anymore, but it still offers excellent diversification for the well informed. Buy for location, buy for build quality, and ignore the hype.