Investing in Kazakhstan 2026: The Middle Corridor, AIFC & Growth

Table of Contents

Wipe the slate clean. If you still view Kazakhstan merely as an oil rich expanse on the map, you are looking at the global economy through a rearview mirror. As of December 2025, the reality is starkly different: this nation is rapidly becoming the logistical heartbeat of Eurasia. While geopolitical friction continues to choke off traditional northern trade routes, the “Middle Corridor” running through Kazakhstan is boomingand smart capital is already laying the groundwork.

When you look at Kazakhstan today, you shouldn’t just see steppe; you should see the world’s largest construction site for future supply chains. With GDP growth hitting 6.3% in the first three quarters of 2025, the Kazakh economy is outpacing its neighbors. But the trillion dollar question remains: Is this a fleeting gold rush, or a structural shift in the global order?

In this guide, we cut through the noise to analyze what actually matters for your portfolio: from the asset protection offered by English Law at the AIFC to the high yield niches in Green Tech and logistics.

Kazakhstan 2026

The Growth Paradigm

Middle Corridor (TITR)

The primary artery for China-Europe trade, bypassing traditional northern routes. Logistics and warehousing demand is at an all-time high.

Green Hydrogen & Energy

Targeting 15% renewables by 2030. Massive investment opportunities in lithium processing and rare earth extraction.

IT & Technopolis

Special Economic Zones like PIT "Alatau" offer 0% CIT for tech ventures, fostering a digital-first ecosystem.

Institutional Rock: The AIFC

Foreign capital is protected by the Astana International Financial Centre, operating under English Common Law principles. This ensures absolute legal certainty, contract enforcement, and international arbitration standards.

`; this.init(); }init() { const cards = this.shadowRoot.querySelectorAll('.stat-card'); const observer = new IntersectionObserver((entries) => { entries.forEach(entry => { if (entry.isIntersecting) { entry.target.style.opacity = '1'; entry.target.style.transform = 'translateY(0)'; } }); }, { threshold: 0.1 });cards.forEach(card => { card.style.opacity = '0'; card.style.transform = 'translateY(30px)'; card.style.transition = 'all 0.8s cubic-bezier(0.23, 1, 0.32, 1)'; observer.observe(card); }); } }customElements.define('kazakhstan-investment-nexus', KazakhstanInvestmentNexus);

Why Now? The “Connector” Effect

Investing in emerging markets is usually a gamble on potential. In Kazakhstan’s case, that gamble is currently hedged by geopolitical necessity. The country sits strategically between China and Europe. With the northern route through Russia no longer viable for many Western companies, trade is flooding into the Trans Caspian International Transport Route (TITR)—better known as the Middle Corridor.

This isn’t just theory. Cargo volumes skyrocketed in 2024. This route is deeply intertwined with regional energy dynamics, similar to the strategic shifts we are seeing with the Azerbaijan Gas & Germany energy alliance. For investors, this means warehousing, logistics terminals, and transport infrastructure are no longer optional “niche” playsthey are strategic imperatives.

Political Stability & Reform: The Reality Check

“Stability” in Central Asia can be a relative term. However, under President Tokayev, Kazakhstan has emerged as the region’s steady hand. The administration is pushing a “Just Kazakhstan” policy, explicitly targeting the dismantling of old monopolies and fostering a robust middle class.

But here is the real hidden gem for Western investors: the Astana International Financial Centre (AIFC). Within this jurisdiction, local laws take a backseat to the principles of English Common Law. This provides a level of legal certainty and contract enforcement that is virtually non existent elsewhere in the region, drastically de risking foreign capital.

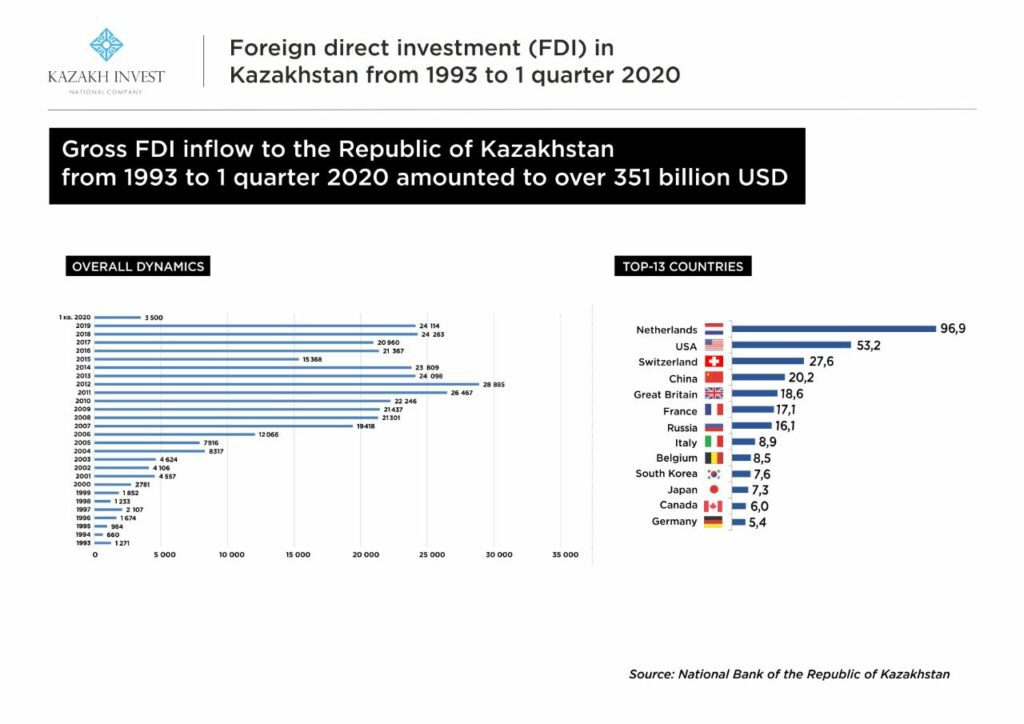

FDI Statistics: Follow the Money

The numbers don’t lie. By the end of 2023, the total stock of Foreign Direct Investment (FDI) exceeded $173 billion. What’s more telling is who is writing the checks:

- The Netherlands: Remains the heavyweight champion, holding roughly 23% of the share.

- USA: Has aggressively closed the gap, now the second largest partner with nearly 20%, driven largely by the energy sector.

- China & Russia: remain critical players, but they are no longer the only game in town.

While the extractive industries (oil, gas, metals) traditionally absorb half of all funding, 2025 has seen a sharp pivot toward manufacturing, IT, and renewables.

Top Sectors for Your 2026 Portfolio

The “Kazakhstan 2050” strategy has moved from paper to pavement. Here is where the smart money is flowing:

1. Critical Raw Materials & Industry

Europe is desperate for rare earth elements for its green transition, and Kazakhstan is sitting on a goldmine of them. From lithium to uranium, the government is no longer content with just digging it up and shipping it out; they want processing to happen domestically. This opens massive doors for foreign technology and machinery providers.

Pro Tip: Building processing plants requires a reliable supply chain. Just as European firms look to Turkish iron casting manufacturers for industrial components, new industrial clusters are forming in Kazakhstan to support this heavy industry boom.

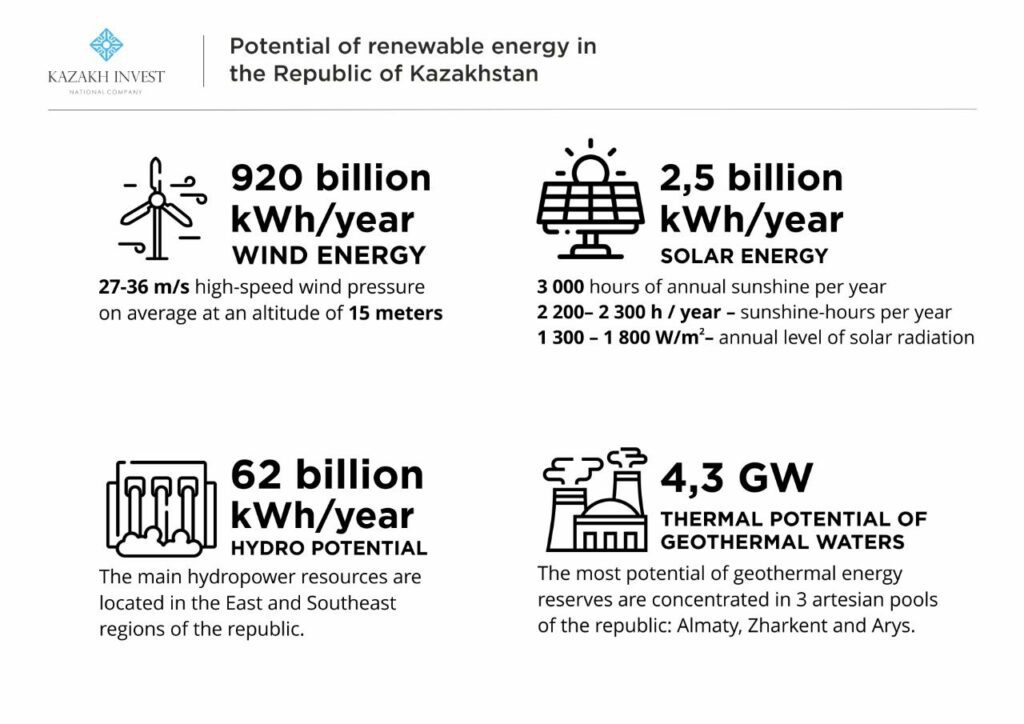

2. Renewable Energy & Green Hydrogen

The target is ambitious: 15% renewable energy share by 2030. As of late 2024, they crossed the 6% mark. With 93 projects in the pipeline and billions in committed capital, this sector is overheating in the best way possible. Keep an eye on the colossal Green Hydrogen projects aimed at exporting directly to the EU.

3. AgriTech: Reviving the Breadbasket

Kazakhstan is already a global titan in wheat exports. Now, the government is subsidizing AgriTech to boost yields. If you are in agricultural machinery or software, the tax breaks here are difficult to ignore.

4. Real Estate & Construction

Urbanization in Astana and Almaty is relentless. The demand for modern Class A office space and residential complexes is currently outstripping supply, driving yields up.

Taxes, Law & Red Tape: The Fine Print

Before you wire any funds, you need to understand the playing field for 2025/2026:

- Corporate Income Tax (CIT): The standard rate is 20%. However, be aware of the new Tax Code changes for 2026—banks face a hike to 25%, while agriculture enjoys a rock bottom 3%.

- VAT (Value Added Tax): Factor this into your margins. An increase from 12% to 16% is set to stabilize the national budget.

- Documentation: Market entry requires paperwork. Similar to the complexities of legal matrimony bureaucracy in Turkey, ensuring your foreign documents are properly legalized and translated is non negotiable for operating here legally.

The Joker Card: Special Economic Zones (SEZ)

There are currently 14 active Special Economic Zones in Kazakhstan. These aren’t just marketing fluff; they are essential for ROI. Operating inside an SEZ often grants you:

- 0% Corporate Income Tax (CIT)

- 0% Land Tax

- Customs duty exemptions on imports

Top zones to watch:

- Seaport Aktau & Khorgos Eastern Gate: The prime spots for logistics and the China Europe trade.

- Astana New City & Technopolis: Focused on construction, infrastructure, and urban tech.

- PIT “Alatau”: The “Silicon Valley” of Kazakhstan for IT startups.

- Turkistan: Emerging focus on tourism and culture.

Your Roadmap: Kazakh Invest

Your first stop should be Kazakh Invest, the state run “One Stop-Shop” for foreign capital. They assist with permits, site selection, and government relations. Use themtheir services are free and can save you months of bureaucratic headaches.

Contact Details (2025/2026):

Address: 55/20 Mangilik El Ave., Block C 4.1, 010000 Astana

Phone: +7 7172 620 620

E-Mail: [email protected]

Website: invest.gov.kz

Conclusion: Fortune Favors the Prepared

Kazakhstan isn’t a market for fast cash; it’s a play for strategic, patient capital. For those willing to navigate the local nuances and leverage tools like the AIFC, the growth potential here rivals anything in emerging Europe. Whether you are looking to diversify your portfoliomuch like exploring banking options in Northern Cyprus—or wanting to build heavy industry on the new Silk Road, Kazakhstan demands a serious look in 2026.