Kuveyt Türk Bank: The Expat’s Guide to Gold & Finance (2026 Outlook)

Table of Contents

If you live in Turkey, you know the drill: protecting the value of your money is a full-time job. Enter Kuveyt Türk Participation Bank (Kuveyt Türk Katılım Bankası). While it consistently ranks among the largest companies in Turkey, its real value for foreigners isn’t its size—it’s the gold.

Unlike traditional banks, Kuveyt Türk operates on Islamic principles (no interest), but its standout feature is the ability to buy gold electronically and convert it into physical bullion. Whether you are looking to hedge against inflation or simply need a reliable banking partner, here is the practitioner’s guide to navigating Kuveyt Türk in late 2025 and beyond.

Who Actually Owns Kuveyt Türk?

Stability is key when choosing a bank abroad. Kuveyt Türk’s shareholder structure is a blend of Gulf capital and Turkish state oversight. As we move into 2026, the ownership breakdown remains solid:

- Kuwait Finance House (57.81%): The majority shareholder and a global leader in Islamic finance.

- General Directorate of Foundations (Vakıflar) (24.49%): A Turkish state institution managing historical foundations.

- Public Institution for Social Security (Kuwait) (8.36%)

- Islamic Development Bank (8.36%)

- Other Shareholders (0.98%)

The “Participation” Model: No Interest, Just Trade

If you ask for a loan with an interest rate, you’re at the wrong bank. Kuveyt Türk uses the “Participation Banking” model.

How it works in practice: Instead of lending you money and charging interest (which is forbidden in Islamic finance), the bank effectively buys the asset (like a house or car) and sells it to you at a profit margin, or they partner with you. For savings accounts, you don’t earn guaranteed interest; you earn a share of the profit the bank generates from its investments.

Core Services for Expats

Kuveyt Türk connects modern tech with traditional values. Here is the curator’s list of services you should actually care about:

- Gold & Metal Trading: The crown jewel. Buy gold electronically 24/7 and pick up physical bars at the branch.

- Participation Accounts: Available in Turkish Lira, USD, and EUR.

- Cards: The “Sağlam Kart” is a popular credit card, alongside standard debit options.

- Digital Banking: A robust mobile app that handles bill payments, taxes, and investments easily.

- XTM Branches: Think of these as ATMs on steroids with a direct video link to a human teller.

- Money Transfers: Supports domestic FAST/EFT, SWIFT, and MoneyGram.

- Financing: Interest-free mortgages and vehicle financing.

Swift Code: Getting Money In

To receive international transfers, you need the BIC/SWIFT code. For the headquarters, use:

KTEFTRISXXX

This 11-digit code works for almost all standard incoming international transfers.

Opening an Account as a Foreigner

Compared to other Turkish banks that might demand an exorbitant deposit just to say “hello,” Kuveyt Türk is relatively expat friendly. However, come prepared. You will need:

- Valid Passport

- Proof of Address: This is often the friction point. A utility bill (gas, water, electricity) in your name is best. If you don’t have one, a residence certificate (Nüfus Kayıt Örneği) works.

- Turkish Tax ID (Vergi Numarası) or a valid Residence Permit (Ikamet).

Insider Tip: If your documents are in a foreign language, you may need them translated and notarized. Check the current fees and process for the Notary Public in Turkey to avoid surprises at the counter.

The German Connection & International Presence

If you have ties to Germany, this bank becomes even more useful. Their subsidiary, KT Bank AG, is the first Islamic bank in the Eurozone.

- Germany (KT Bank AG): Headquartered in Frankfurt with branches in Berlin, Cologne, and Munich. (Note: The network changes, so check the specific availability in Munich before visiting).

- Bahrain: A licensed branch for international wholesale banking.

XTM: The Introvert’s Best Friend

The XTM is a hybrid between an ATM and a branch. If you speak English or Arabic but your local branch staff doesn’t, go to an XTM. You video call a centralized agent who speaks multiple languages (and even sign language).

You can open accounts, print documents, and deposit cash here. It is particularly useful during Turkish public holidays when physical branches are locked up tight.

Gold Banking: Why Expats Choose Kuveyt Türk

With producer prices and inflation trending upward, keeping savings in Lira can be stressful. Kuveyt Türk allows you to hold gold digitally and crucially withdraw it physically.

- Buying/Selling: Trade gold 24/7 via the app (995/1000 purity).

- Physical Withdrawal: You can walk out of the branch with anything from 1 gram to 1 kg bars, or traditional “Quarter Gold” (Çeyrek) coins.

- The Cost (Indicative Fees): There is a commission for converting digital gold to physical metal, based on Kuveyt Türk’s current fee schedule.

- Gram Gold: Expect a commission of around 4% of the value.

- Quarter Gold (Çeyrek): Fees hover around 140 TL per piece.

- 1 kg Bars: Fees are significantly higher (approx. 100,000 TL), depending on current rates.

- Gold Days: Have old jewelry? Bring it to the bank on specific “Gold Days,” get it appraised, and deposit the value directly into your account.

Silver & Platinum Accounts

For those looking to diversify beyond gold:

- Silver: Trade starting from 0.01 grams. Physical withdrawal is possible (often as granules), though logistics fees may apply for bulk amounts.

- Platinum: Good for electronic portfolio diversification, though physical delivery is rare and requires prior arrangement.

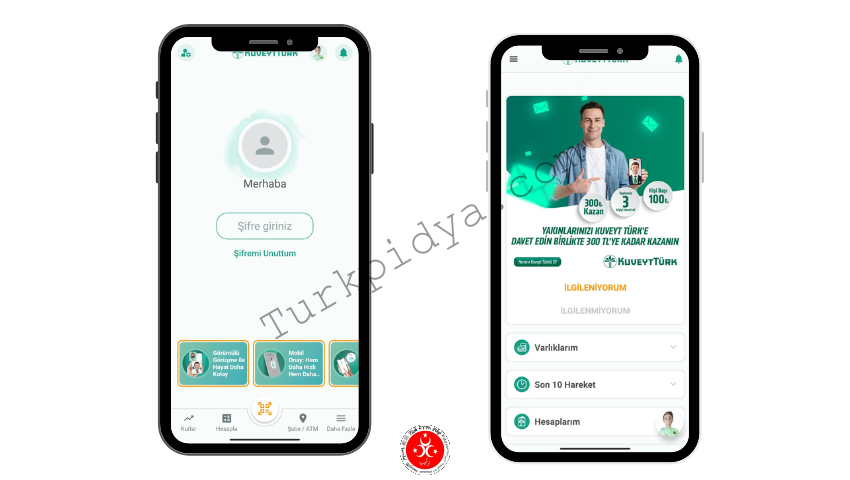

The Mobile App

The interface is clean and fully localized. You can toggle the app to English, Turkish, or Arabic. It handles everything from gold trading and QR code payments to financing management.

For official updates, always check kuveytturk.com.tr.