VakıfBank Turkey: Expat Guide to Accounts, SWIFT & Branches

Table of Contents

If you live in Turkey, invest here, or just visit frequently, you eventually hit a wall where cash and international cards aren’t enough. You need a local IBAN. VakıfBank is often the default choice for foreigners because of its sheer sizeit is everywhere.

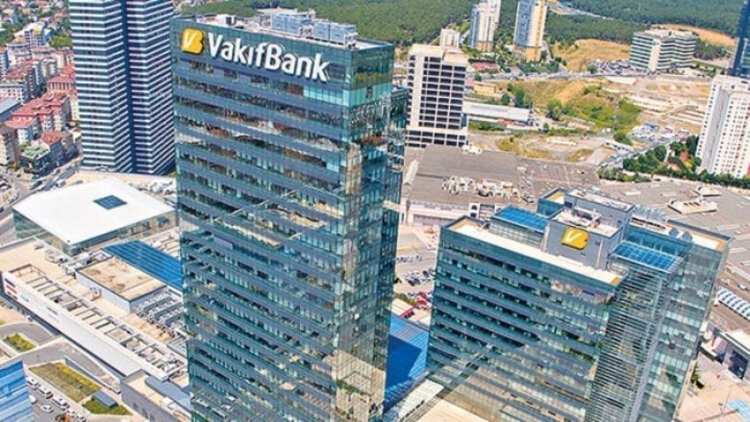

But let’s be real: walking into a branch isn’t always a smooth experience. While private banks might offer fluffier service, VakıfBank is the engine room of the Turkish economy. As of late 2025, it remains the second largest bank in Turkey. Official reports from September 2025 show a massive network of 973 domestic branches and a balance sheet topping 5 Trillion TL. If you want stability, this is it.

For a broader look at who dominates the market, check out our analysis of the Largest Companies in Turkey.

Historically, VakıfBank was founded to manage the cash flows of charitable foundations (Vakıflar), a system dating back to the Ottoman Empire. Today, it’s a modern financial giant, but that bureaucratic heritage still shows in the paperwork.

Services: What You Actually Use

For most expats and digital nomads, VakıfBank covers the essentials. It isn’t just about storing Lira; it’s about paying bills without queuing at the PTT.

- Loans: Consumer, business, and auto loans. (Planning to drive? Read our guide on Buying a Car in Turkey as a Foreigner first).

- Mortgages: Financing for property investment.

- Online Banking: Crucial for paying electric, water, and internet bills automatically.

- Transfers: FAST (instant local transfers) and SWIFT.

- Cards: Credit, Debit (Bankomat), and Prepaid options.

- FX & Gold: Multi currency accounts (USD, EUR, GBP) and Gold accounts, which are very popular locally for inflation hedging.

- Government Payments: Direct integration for paying taxes and fees.

Practitioner’s Tip: Don’t assume every branch offers the same service. Branch managers have significant autonomy. If one branch says “no” to opening an account, walk 500 meters to the next one. It’s often not company policy; it’s just that specific manager’s risk appetite that day.

VakıfBank SWIFT Code

If you are sending money the old fashioned way (bank to-bank), you will need the BIC/SWIFT code. For the headquarters, it is:

TVBATR2A

Note: Always double check this inside your specific online banking dashboard, as some branches or specific account types might route differently.

Opening an Account as a Foreigner

This is where the rubber meets the road. Can you open an account? Yes. Is it easy? It depends on your status.

Scenario A: You Have a Residence Permit (Ikamet)

If you have a valid ID card (Kimlik), the process is standard. Bring the following to the branch:

- Original Passport

- Turkish Tax ID (Vergi Numarası): Even if you have a Kimlik, they often ask for the Tax ID document.

- Proof of Address: This is the tricky part. A rental contract often isn’t enough. They usually want a utility bill in your name or a document from the Population Registry (Nüfus) showing your address is registered in the system.

Scenario B: The Non Resident (No Residence Permit)

This is the “Hard Mode.” Without a residence permit, banks are wary of compliance risks. Policies change monthly.

As of late 2025, reports suggest VakıfBank can open accounts for non residents, but there is usually a catch. You may be asked to:

- Deposit a significant sum (often quoted around 2,000,000 TRY or equivalent in hard currency).

- Register for “Private Banking” services.

Warning: Do not book a flight solely to open a bank account based on internet advice. Call the specific branch beforehand. If you don’t speak Turkish, bring a translator.

Scenario C: Corporate Accounts

Opening a clear business account for a foreign company is a documentation marathon. You will need:

- Potential Tax ID for the company in Turkey.

- Articles of Association.

- Passport copies of major shareholders (25%+).

- Chamber of Commerce Registry documents.

- Signature Circular (Imza Sirküleri): A notarized document showing who is allowed to sign for the company.

Almost all foreign documents must be translated and notarized in Turkey. To understand the costs involved in this, read our breakdown of the Notary Public in Turkey: Fees & Process. Also, if you are setting up a local entity, check our guide on Starting a Company in Turkey.

The Smarter Way to Transfer Money: Wise

Using SWIFT to send money to Turkey often results in “surprise” deductions. The intermediary banks take a cut, and the exchange rate offered by traditional banks is rarely in your favor.

We recommend Wise (formerly TransferWise) for one reason: Transparency.

Wise uses the mid market rate (the one you see on Google) and charges a visible fee upfront. No guessing games.

Fee Snapshot (Late 2025 Estimates)

- The Cost: A small fixed fee + a percentage of the transfer.

- Example: Sending 1,000,000 TRY from a Euro account cost approx. 4,702 TRY in fees (subject to change), which is significantly cheaper than the exchange rate spread spread most banks charge.

- Limits: You can send up to roughly 10 Million TRY per transaction.

Why Wise Beats SWIFT for Turkey

- Speed: Many transfers to Turkish IBANs land in seconds or minutes.

- Savings: You avoid the “bad” exchange rates banks use to hide fees.

- Digital: No branch visits required.

You can check the real exchange rate and transfer money to Turkey instantly by clicking here.

Digital Banking: The App Reality

Once your account is open, download the app immediately. Turkish banking apps are miles ahead of many European counterparts in terms of functionality. You can handle:

- QR Code payments (very common in Istanbul).

- Turning foreign usage on/off for your cards.

- Paying traffic fines and taxes.

International Presence

VakıfBank isn’t just domestic. If you are doing business between Turkey and the world, their foreign footprint might help:

- Branches: New York, Bahrain, Erbil (Iraq), Qatar Financial Centre.

- VakıfBank International AG (Europe): Headquartered in Vienna, with branches in Cologne and Frankfurt. This subsidiary focuses on trade finance and corporate loans for Europe Turkey business.

Credit Ratings (2025 Status)

For the financial nerds or corporate treasurers, here is how the agencies see VakıfBank as of late 2025:

Moody’s (July 2025)

| Category | Rating |

| Long Term FX Deposits | Ba3 (Stable) |

| Long Term Local Currency | Ba3 (Stable) |

Fitch Ratings (November 2025)

| Category | Rating |

| Long Term IDR (FX) | BB- (Stable) |

| National Long Term (Turkey) | AA (tur) (Stable) |

FAQ: The Rapid Fire

Can a foreigner open a VakıfBank account?

Yes. If you have a residence permit, it is straightforward. If you are a non resident, be prepared for high deposit requirements (often 2M+ TRY) and potentially needing to use Private Banking services.

What documents do I need?

At minimum: A valid passport, a Turkish Tax ID number (Vergi Numarası), and a verified proof of address (utility bill or Nüfus document). Business accounts require significantly more documentation, including notarized translations.