Turkish Free Zones: Locations, Tax Benefits & Strategy 2026

Table of Contents

Turkish Free Trade Zones are not just tax advantaged areas; they are the strategic back door to the European market.

For international investors, the calculation is often simple: Turkey offers a geographic bridge between East and West, combined with competitive labor costs. But the real ace up the sleeve is the Free Zone (Turkish: Serbest Bölgeler). If you manufacture here, you can operate almost entirely tax-free under specific conditions.

But a warning is necessary: The model has evolved. This is no longer a blanket tax haven for shell companies. It is a high performance hub for genuine production and export. We are looking at the hard facts for the 2026 fiscal landscapestripping away the sales fluff.

What Are Turkish Free Zones, Really?

Free Zones are fenced in, special sites within Turkey that are legally considered outside the Turkish customs territory. This means that even though you are physically standing on Turkish soil, the usual bureaucratic and fiscal rules do not applyor apply very differently.

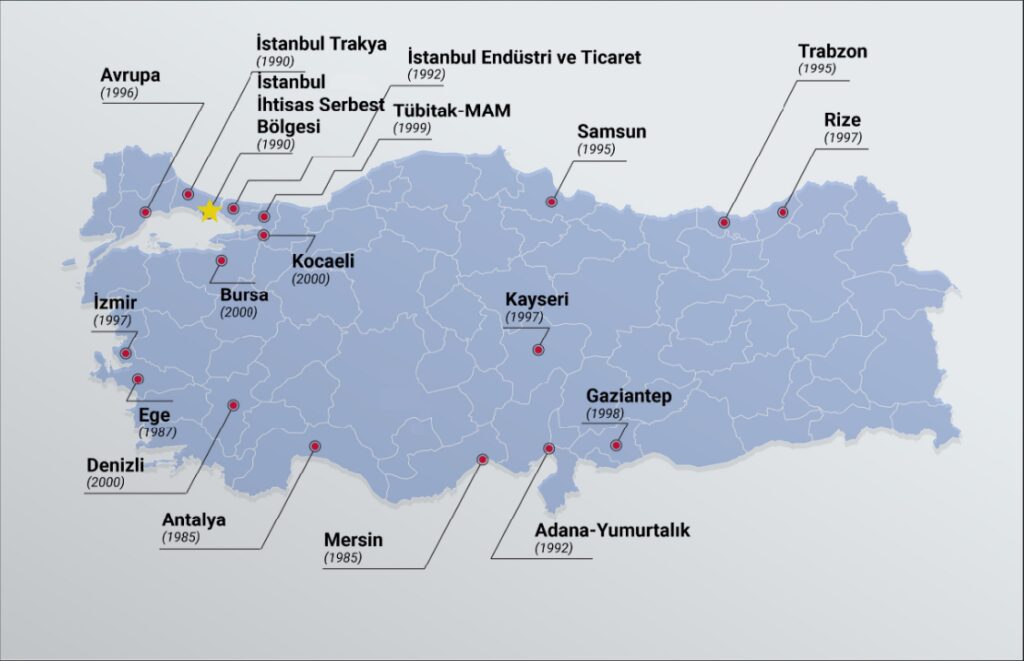

The government’s goal is straightforward: Export promotion. The state foregoes tax revenue to bring technology, foreign currency, and jobs into the country. Currently, there are 19 Free Trade Zones in Turkey. 18 are fully active, and one (the Western Anatolia Free Zone) is currently under development.

The Financial Reality: Tax & Incentives

This is where the reality check happens. Many guides promise blanket tax exemptions. The truth is more nuanced: The biggest benefits are reserved primarily for manufacturing companies, not pure trading firms. Here is the current incentive structure:

- 0% Corporate Tax: Manufacturing companies are 100% exempt from corporate tax. This is the single most important lever for your ROI.

- 0% Income Tax for Employees: If you export at least 85% of your products, the income tax on your employees’ salaries is completely waived.

- Duty Free: Goods brought into the zone from abroad are exempt from customs duties. This is ideal for processing raw materials.

- No VAT (KDV): Supplies and services within the zone, as well as sales from Turkey into the zone, are completely exempt from Value Added Tax.

- Free Profit Transfer: There are no restrictions on transferring profits from the Free Zone to foreign countries or back into Turkey.

- Real Estate Advantages: Exemption from property tax and often from fees during property acquisition.

Practitioner’s Tip: Pay close attention to whether your business model is classified as “Production” or “Trading.” Pure traders benefit from customs advantages but often lose the full corporate tax exemption that makes these zones so lucrative.

Strategic Hubs: Choosing Your Battleground

Location dictates your logistics costs. The 19 zones are strategically distributed, mostly near major ports. For Turkey’s foreign trade, these are the critical nodes:

1. Marmara Region (The Industrial Heart)

This is the economic engine of Turkey. It is the default choice for companies needing proximity to Istanbul and Europe.

- Istanbul Atatürk Airport Free Zone: Focused on services, software, and high value, low weight goods.

- Istanbul Industry & Trade: A heavyweight for diverse heavy industries.

- Kocaeli & Bursa: The epicenter for the automotive and heavy industries. If you are in manufacturing, you should look at Kocaeli: Istanbul’s Industrial Engine for a deeper dive into this specific ecosystem.

- European Free Zone (Çorlu): Strategically positioned for land transport directly into the EU.

2. Aegean Region (Gateway to the Mediterranean)

Izmir is a hotspot for export companies, particularly in textiles, food, and renewable energy.

- Aegean Free Zone (ESBAS – Izmir): One of the most modern and largest zones in Turkey.

- Izmir Free Zone (IZBAS – Menemen): A rapidly growing alternative.

- Denizli: The undisputed capital of the textile industry.

3. Mediterranean Region (Middle East & Logistics)

Ideal for trade with the Middle East and North Africa (MENA) region.

- Mersin: Turkey’s very first Free Zone, located directly at a massive port facility.

- Antalya: Famous for luxury yacht building and medical technology.

- Adana Yumurtalık: Focuses on heavy industry and petrochemicals.

4. Black Sea & Anatolia

These zones often offer lower operating costs and serve specific niches.

- Trabzon, Rize, Samsun: Logistics hubs on the Black Sea coast.

- Gaziantep, Kayseri, Mardin: Strong industrial bases deep in the interior.

Approved Activities: What Can You Do?

Turkish authorities are flexible, provided the activity benefits the economy. Common approved activities include:

- Manufacturing & Assembly: The “Sweet Spot” for tax breaks.

- Research & Development (R&D): Highly subsidized, often connected with Technoparks.

- Software Development: Increasingly popular due to remote work models.

- Warehousing & Packaging: Using the zone as a logistics hub for re export.

- Trading: Import and sales (though with limited tax advantages compared to manufacturing).

The Friction: Setup & Bureaucracy

Despite the advantages, entering a Free Zone is not automatic. The bureaucracy is rigorous. You will need an Operating License (Faaliyet Ruhsatı) from the Ministry of Trade and must sign a contract with the zone operator.

Prepare yourself for the paperwork. Documents often require formal legalization of foreign documents or heavy notarization. If you are unfamiliar with the local system, read our guide on the Notary Public in Turkey to understand the power they hold. Professional local advice is essential to choose the right zone for your specific sectorbecause not every zone is suitable for every industry.