Car Insurance in Turkey: A Comprehensive Guide for Foreigners on Acquiring

Table of Contents

Discover everything you need to know about acquiring car insurance in Turkey as a foreigner. Our comprehensive guide dives deep into the winding roads of Turkish insurance policies, ensuring you’re fully prepared for your journey.

To safely navigate through Turkey’s bustling streets and scenic roads, car insurance is a necessity, not a luxury. Here’s your comprehensive guide, outlining everything you need to know about car insurance in Turkey, from its importance to how to get it, so you can keep traveling with peace of mind.

Why Is Car Insurance Necessary in Turkey?

Car insurance in Turkey, also known as compulsory financial liability insurance (Trafik sigortası), is a type of insurance defined by the Turkish Highway Traffic Law No. 2918. It primarily aims to indemnify the damage incurred by the other party in the event of an accident.

Traffic insurance is essential to cover the financial liability if you cause an accident. Under Turkish law, the party responsible for an accident must cover damage to the other party’s vehicle, hospital and treatment costs for the driver and other passengers, and if the accident is fatal, death compensation.

Failure to meet these obligations could result in severe penalties, including fines, foreclosure, and even incarceration. However, if you regularly pay your car insurance premiums and have active insurance, the insurance company bears the high-cost compensations.

How Does Car Insurance Work?

The essence of car insurance is that it offers assurance against physical and financial damages that may arise from traffic accidents. It helps you cover the compensation that you’re obligated to pay within the scope of your policy agreed upon with the insurance company.

In cases of accidents during both intercity and intracity travels, the scope of the policy reduces the financial losses of the vehicle owner. If at fault in an accident, the policy could cover substantial financial expenses including material damages, injuries, third party liabilities, death benefits, and legal costs.

The range of the traffic insurance can be broadened by including extra provisions in the policy. Choosing the most comprehensive policy that aligns with the characteristics of your vehicle ensures that financial loss is minimized in the event of an accident. Under the scope of traffic insurance, the treatment and medication costs of the accident victim are fully covered by the Social Security Institution.

Car Insurance Price in Turkey

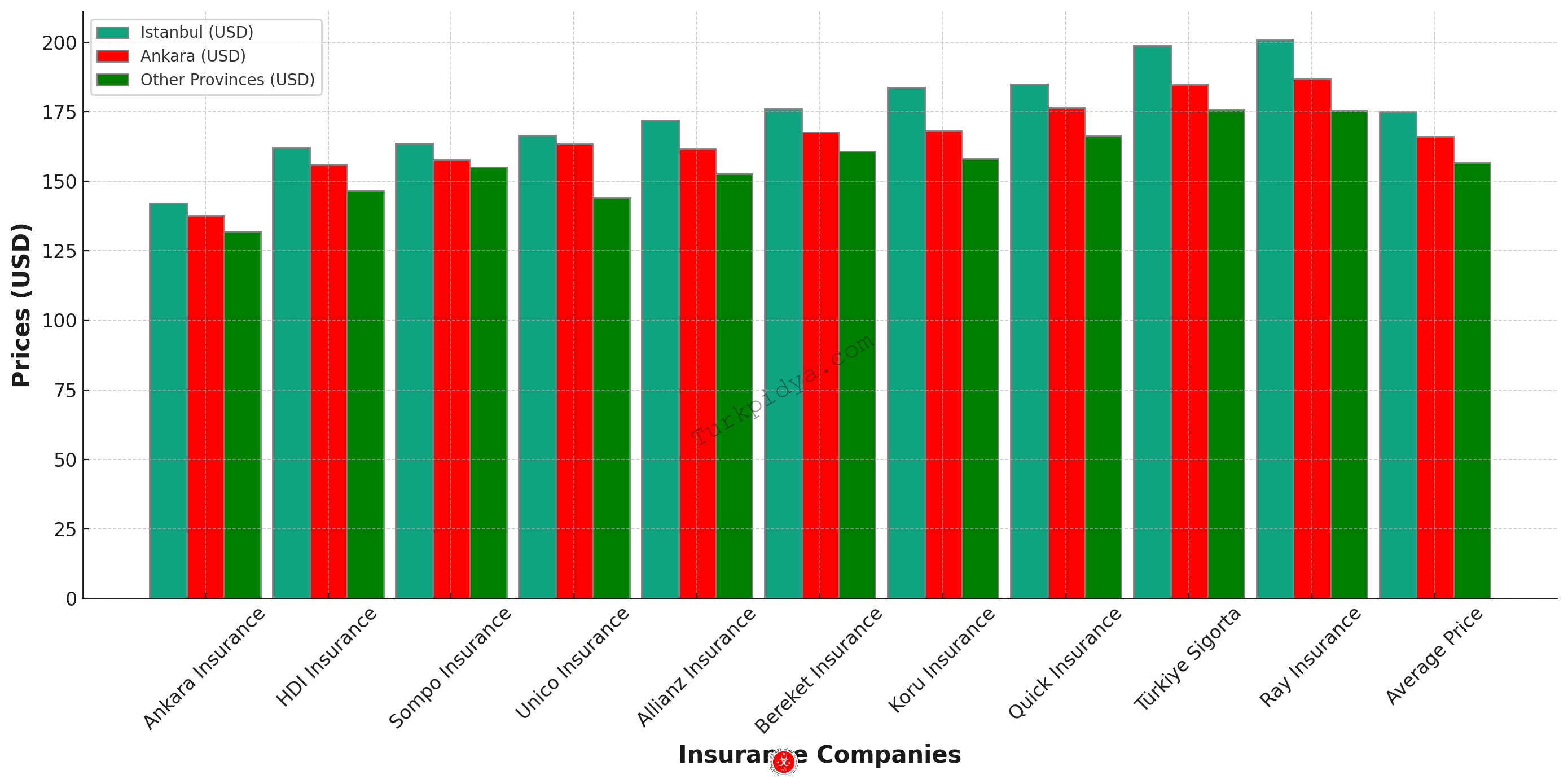

In this table you can see the Car Insurance Price in Turkey in USD. The prices are average.

| Insurance Companies | Istanbul (USD) | Ankara (USD) | Other Provinces (USD) |

|---|---|---|---|

| Ankara Insurance | 142.08 | 137.75 | 132.02 |

| HDI Insurance | 162.06 | 155.84 | 146.67 |

| Sompo Insurance | 163.69 | 157.70 | 155.22 |

| Unico Insurance | 166.46 | 163.43 | 144.07 |

| Allianz Insurance | 172.05 | 161.62 | 152.59 |

| Bereket Insurance | 176.07 | 167.68 | 160.84 |

| Koru Insurance | 183.82 | 168.20 | 158.21 |

| Quick Insurance | 184.89 | 176.42 | 166.20 |

| Türkiye Sigorta | 198.73 | 184.86 | 175.82 |

| Ray Insurance | 201.11 | 186.78 | 175.49 |

| Average Price | 175.04 | 166.02 | 156.70 |

- Highest Prices:

- Ray Insurance and Türkiye Sigorta have the highest prices in all three locations, with Ray Insurance being the most expensive overall.

- Lowest Prices:

- Ankara Insurance offers the lowest prices across all three locations.

- Istanbul Pricing:

- The average price in Istanbul is approximately USD 175.04, with most companies pricing their insurance above this average.

- Ankara Insurance, HDI Insurance, and Sompo Insurance are below the average price in Istanbul.

- Ankara Pricing:

- The average price in Ankara is approximately USD 166.02.

- Ankara Insurance, HDI Insurance, and Allianz Insurance have prices below the average in Ankara.

- Other Provinces Pricing:

- The average price in Other Provinces is approximately USD 156.70.

- Ankara Insurance, HDI Insurance, Unico Insurance, and Koru Insurance are below the average price in Other Provinces.

- Price Differences within Companies:

- Unico Insurance and Sompo Insurance have smaller differences in their prices across the three locations compared to other companies.

- Ray Insurance and Türkiye Sigorta exhibit a larger price difference between Istanbul and the other two locations.

- Above Average Companies:

- Bereket Insurance, Koru Insurance, Quick Insurance, Türkiye Sigorta, and Ray Insurance have prices above the average in all three locations.

- Consistency in Ranking:

- The ranking of companies from the least expensive to the most expensive is relatively consistent across the three locations.

Traffic Insurance Ceiling Prices

As of September 2023, the traffic insurance ceiling prices vary based on the damage stage(your no-claim history) and the location of the vehicle’s registration. For example:

- For a damage stage 0 in Istanbul, the ceiling price is approximately $704.81, while in Ankara it’s $684.87 and $665.13 for Izmir.

- As we go down to damage stage 7, the ceiling price drops to approximately $140.97 for Istanbul, $136.97 for Ankara, and $133.07 for Izmir.

You may use the insurance ceiling price calculator page to ascertain the ceiling price based on your specific damage step.

Compulsory Traffic Insurance Coverages

Compulsory traffic insurance policies cater to two coverage categories – Main and Additional. The main coverages, which are included in every policy, are:

- Material Damage Coverage

- Medical Expenses Coverage

- Permanent Disability Benefit

- Death Benefit

Additional coverage options are selected based on the risk group and the style of use, which include:

- Assistance Guarantee

- Mini repair service

- Cigarette burn

- Legal protection

The coverage limits of traffic insurance change annually. The limits, as determined by the Undersecretariat of Treasury for 2023, are as follows:

- For Cars/Taxi: Material damage per vehicle is pegged at 120,000TL and 240,000TL per accident, while the medical cost per accident is capped at 1,200,000TL for per person and 6,000,000TL per accident. Similar figures are set for cases of injury and death.

- For Motorcycles: Material damage per vehicle and accident is at 120,000 and 240,000TL respectively, while the medical cost per accident is set at 500,000TL for per person and 3,600,000TL per accident. Corresponding figures are also applicable for cases of injury and death.

Please remember, your traffic insurance will only cover up to the prescribed ceiling in case of an accident. You must cover any excess. However, if you have supplementary liability coverage in your comprehensive motor insurance, your automobile insurance can cover the remainder of the amount over your coverage limit.

Traffic Insurance Renewal

Traffic insurance is a yearly compulsory requirement. It must be renewed before your current policy’s expiry to ensure your vehicle’s legal roadworthiness. Considering that the guarantees and limits of traffic insurance are standardized, it is advisable during renewal to get multiple premium offers from different insurance companies. This allows you to compare and choose the most cost-effective option for your needs.

To conclude, as a car owner in Turkey, understanding the ins and outs of traffic insurance is critical. Not only does it offer financial protection in case of mishaps, but it is also essential to abide by the legal obligations of car ownership in the country.

How is Car Insurance Procured?

Acquiring compulsory car insurance is quite a straightforward process:

- You require a quote. This is the first step and plays a crucial role in obtaining a policy with additional premiums if desired.

- During quote preparation, car insurance premium calculations are done. In these calculations, several factors are considered such as the age, brand, and model of the vehicle being insured, the city in which it’s registered, the age of the owner, and the no-claims discount.

- To receive a personalized insurance quote, the vehicle’s license plate, registration and personal details of the vehicle owner are needed, alongside the vehicle’s specific details.

- If available, you can query the expiry date of your car insurance, traffic violation fines, and claim record status online by entering your Turkish Identification Number and license plate details.

- After correctly entering the necessary information, various policy types from different companies will appear for your consideration.

- After choosing a suitable insurance offer, you can make your payment using online banking and quickly obtain your car insurance.

- After the purchase, the policy is sent to your email address. Thus, you can safely store your policy in the digital environment.

You can renew your car insurance online when the renewal date comes.

Is it possible to get short-term car insurance? The general rule is that car insurance, like other types of insurance, is taken out annually. There are, however, two exceptions:

- Temporary plate holders can have short-term insurance.

- International passenger and goods transport vehicles with foreign plates can also be insured on a short-term basis.

Is Car Insurance Mandatory?

Yes, car insurance is obligatory, and driving without it is prohibited. There are punitive measures for not having insurance. In 2023, vehicle owners identified by traffic police to be driving without insurance will face a fine of 426 TL.

Is it Mandatory to Keep Car Insurance in the Vehicle?

You are not required to carry your car insurance policy in the car. This requirement used to exist, with the insurance policy obligatory to be in the car and shown when requested by traffic police. However, with modern advancements, traffic police can access vehicle information and check for an insurance policy digitally, thus nullifying that regulation.

Nevertheless, there are some traffic officers who might not be aware of this advancement, so having a copy of your compulsory car insurance policy in the car might be beneficial.

What to Do If Your Car Insurance Policy Is Lost?

If your car insurance paper is lost, the first thing to do is get a printout of the policy if it was sent to you via email by your insurance company. In an era where insurance companies share policies via email, the loss of an insurance paper ceases to be an issue. If the policy isn’t available online, you can request another from your insurance company.

What Does Car Insurance Cover in Turkey?

Car insurance covers the damage costs inflicted on the other party during an accident. It makes damage payments within set limits and also covers medical costs for physical injuries.

What is the Difference Between Comprehensive Insurance (Kasko) and Car Insurance?

Comprehensive and car insurances are often confused. Comprehensive insurance (Kasko) is designed to cover the owner’s losses, while car insurance is for the damages to the third party. Comprehensive insurance (Kasko) is optional while car insurance is mandatory, but the choice of the insurance company is left to the discretion of the car owner. The absence of car insurance results in fines for delay and driving without a complete document, and subsequently, the car is taken into custody by the police. This does not happen with comprehensive insurance (Kasko) since it’s optional.

Car insurance covers the other party’s damages within the official limits depending on the incident, while with comprehensive insurance (Kasko), the situation is different. In the case of theft, burning, or accidents involving the insured vehicle, payments are made based on the agreement with the company and the policy and premium amount, without any official limit.