Borsa Istanbul: The 2026 Guide to Turkey’s Stock Exchange (BIST)

Table of Contents

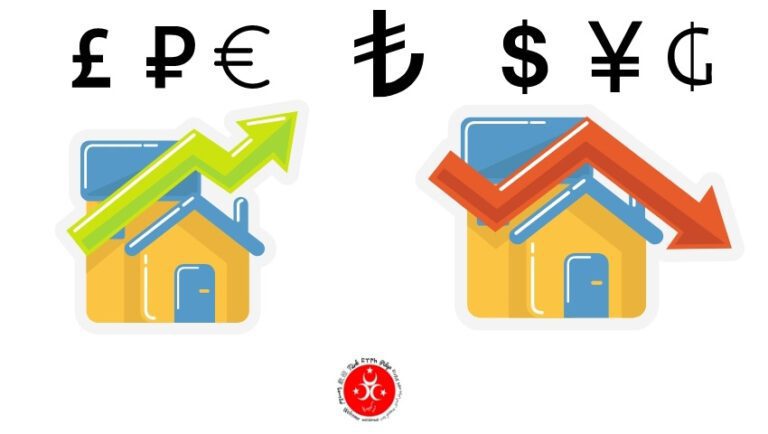

Forget everything you know about “boring” stock markets. In recent years, the Turkish stock exchange (Borsa Istanbul) has evolved into one of the most dynamic financial arenas in the world. Why? Because for many in Turkey, it’s not just a place for speculationit’s a necessary shield against inflation. While traditional currencies fluctuate, investors flock to corporate assets for security.

This guide isn’t a dry financial textbook. We are cutting through the noise to explain exactly how the Borsa Istanbul (BIST) works, what lies behind the tickers BIST 100 and BIST 30, and how youwhether an expat or an international investorcan participate in 2026.

What is Borsa Istanbul (BIST)?

Borsa Istanbul, or BIST, is the sole official stock exchange of Turkey. It is the beating heart of the Turkish capital market, connecting investors with companies. The BIST in its current form was established on April 5, 2013, through the merger of the Istanbul Stock Exchange (ISE), the Gold Exchange, and the Derivatives Exchange. This consolidation created a unified platform for equities, commodities, and derivatives.

The success of the BIST is inextricably linked to the Turkish economy: the more liquid and active the market, the more capital is available for corporate innovation. The institution is steered by a nine member board of directors determining its strategic direction.

A Brief History: From 1926 to Today

While modern trading is often associated with the 1980s reforms, the roots of Turkish capital markets stretch back to 1926. However, the true catalysts for the modern market came later:

- 1981: The Capital Markets Law was enacted, laying the legal foundation.

- 1986: The Istanbul Stock Exchange (IMKB) officially began operations on January 2nd under the chairmanship of Muharrem Karslı.

- 2013: A major rebranding to “Borsa Istanbul” (BIST) unified all Turkish trading venues under one roof.

Market Structure: BIST 100 vs. BIST 30

If you want to invest in Turkey, you need to speak the language of its indices. These are the barometers of the economy.

BIST 100: The Benchmark

The BIST 100 is to Turkey what the S&P 500 is to the US or the DAX is to Germany. It comprises the 100 most valuable and most traded companies on Borsa Istanbul. When news headlines read “Turkish stocks are up,” they are almost always referring to this index (Ticker: XU100). It provides a comprehensive overview of the broad market across various sectors.

BIST 30: The Elite

The BIST 30 is the “Blue Chip” club of the Turkish exchange. It contains the 30 largest and most liquid companies in the country. These firms are reviewed and re evaluated quarterly based on strict criteria:

- Market Value: Only companies with the highest market capitalization make the cut.

- Liquidity: High daily trading volume is mandatory.

Practitioner Tip: Stocks in the BIST 30 are generally considered less volatile than smaller “Submarket” equities. They typically belong to the “Yıldız Pazar” (Star Market), the segment for the most reliable and largest corporations. While historic classifications like Group A or B exist, today you should focus on the Star Market for stability.

How Many Companies Are Listed?

The Turkish equity market is experiencing a massive influx of new capital. As of November 2025, there are over 640 companies listed on Borsa Istanbul. This number is steadily growing as more firms pursue Initial Public Offerings (IPOs) to raise capital for expansiona sign of a vibrant, albeit volatile, business ecosystem. If you are interested in the broader business landscape, check out our guide on starting a company in Turkey.

Trading Hours: When Can You Trade?

The schedule has modernized significantly in recent years. The old lunch break, where trading would halt, is gone. Today, Borsa Istanbul operates on a continuous trading basis. The hours (Istanbul Time, UTC+3) are:

- 09:40-09:55: Opening Session (Order Collection)

- 09:55-10:00: Price Determination & Matching

- 10:00-18:00: Continuous Trading (The Main Session)

- 18:00-18:10: Closing Session and Price Determination

Trading occurs on all official workdays, Monday through Friday. On national holidays, the exchange is closed or closes early (often at 12:40 PM before major festivals).

IPOs: The Engine of Growth

An Initial Public Offering (IPO) is a critical step for Turkish companies towards professionalization. Before a company can trade on the BIST, its prospectus must be approved by the Capital Markets Board (SPK). Once approved, “Bookbuilding” begins, where investors submit their bids.

Why is there such an IPO craze in Turkey?

- Financing: It offers cheaper capital compared to high interest bank loans.

- Prestige: Listed companies often command more trust from banks and international partners.

- Liquidity: Founders and Venture Capitalists can realize their gains.

Practical Guide: How to Buy Turkish Stocks

The process depends entirely on your residency status. Here is the reality of navigating the system.

1. For Residents (Expats & Locals)

If you live in Turkey and possess a Foreigner ID Number (Yabancı Kimlik Numarası), access is straightforward. You can open an investment account at any major bank. However, for a smoother digital experience, many are turning to fintech apps. This is similar to the process of finding a job in Turkey—digital tools are replacing traditional methods.

The current market favorite is MIDAS. It offers low fees and an interface that modern investors expect.

? Tip: Use MIDAS as a mobile broker for fast access to the BIST and even US markets.

2. For International Investors (Non Residents)

If you don’t live in Turkey, opening a local bank account can be a bureaucratic nightmare. Here are two elegant workarounds:

- ETFs (Exchange Traded Funds): The easiest route. The iShares MSCI Turkey ETF (TUR) is listed on US exchanges and tracks a significant portion of the BIST 100. You buy it just like any other stock through your home broker.

- International Brokers: Platforms like Interactive Brokers allow international clients to trade directly on Borsa Istanbul, provided you enable the specific trading permissions in your settings.

Currency and Risk

All transactions on the BIST are settled in Turkish Lira (TRY). For foreign investors, this introduces “Currency Risk.” Gains in the stock market can be wiped out if the Lira depreciates against your home currencyor multiplied if the Lira strengthens. This dynamic makes the Turkish market thrilling but risky.

If you want to dive deeper into the real economy driving these stocks, look at our analyses of heavy industries, such as the top Turkish shipyards which are becoming global heavyweights.