Table of Contents

Turkey, strategically positioned at the crossroads of Europe and Asia, is rapidly emerging as a global economic powerhouse. A key ingredient in this success story is its network of free zones, special economic areas offering businesses a unique set of advantages to thrive in international trade.

Imagine these zones as islands of economic opportunity, physically within Turkey’s borders but operating outside its customs area. They offer a distinct advantage for companies seeking to expand their global reach and capitalize on Turkey’s strategic location.

From Seed to Tree: The Growth of Turkey’s Free Zones

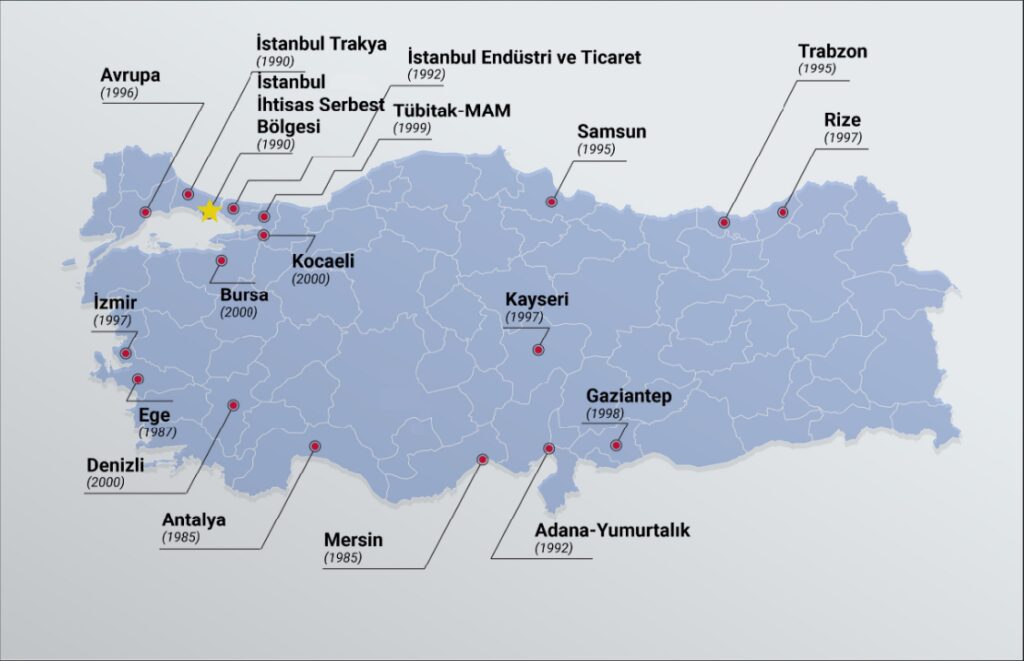

The concept of free zones took root in Turkey in 1985 with the establishment of the first zone in Mersin. Since then, the number of free zones has steadily grown to 19, strategically scattered across the country. This expansion reflects Turkey’s commitment to nurturing its export potential and attracting foreign investment and advanced technology.

These zones are more than just tax havens; they are carefully curated ecosystems designed to foster growth and innovation. They offer companies:

A Toolbox of Incentives for Foreign Investors

- Tax Freedom: Enjoy exemption from customs duties and taxes on imported goods and equipment, significantly reducing operational costs.

- Streamlined Bureaucracy: Experience a simplified business setup process with minimal red tape, allowing companies to hit the ground running.

- Financial Flexibility: Freely transfer profits generated within the zone abroad, giving investors greater control over their earnings.

- Level Playing Field: Enjoy the same rights and protections as local Turkish companies, ensuring a fair and inclusive business environment.

Turkey’s free trade zones are home to 1,900 businesses, approximately 500 of which are foreign-owned, with a combined trade volume of $22 billion in 2020. Until 2021, foreign capital businesses invested in the zones to the tune of more than $2.5 billion.

Activities in Turkish Free Zones

In general, Turkish Free Zones allow for a wide range of activities, including:

- Manufacturing

- Research and Development (R&D)

- Software

- General trading

- Storing

- Packing

- Banking and insurance

- Assembly and disassembly

- Maintenance services

While investors are permitted to construct their own facilities, zones frequently offer favorable rental rates for office and warehouse space. Opportunities for joint ventures exist in every area of the economy for Turkish and foreign businesses.

Specialized Hubs for Growth: Sector-Specific Free Zones

Turkey’s free zones are not one-size-fits-all. They are tailored to cater to specific sectors, creating specialized hubs of expertise and innovation.

For example, the Bursa Free Zone is a powerhouse for the automotive and textile industries, while the Istanbul Leather and Industry Free Zone thrives on leather processing and related businesses. This sector-specific focus encourages collaboration, knowledge sharing, and supply chain efficiency, propelling these industries forward.

A Treasure Trove of Tax Incentives and Exemptions

The benefits don’t end there. Turkey’s free zones offer a generous package of tax incentives, making them even more attractive for businesses:

- 100% Corporate Income Tax Exemption: Manufacturing companies within free zones are completely exempt from corporate income tax, a significant financial advantage.

- Reduced Labor Costs: Exporting companies benefit from a 100% income tax exemption on employees’ wages, making them even more competitive in the global market.

- Stamp Duty Relief: Transactions and documents related to free zone activities are exempt from stamp duties and fees, reducing the financial burden on companies.

A Network of Opportunity: Turkey’s Free Zone Locations

There are a total of 21 free trade zones in Turkey, most of them are located near EU and Middle Eastern markets. FZs are strategically located near ports on the Mediterranean, Aegean, and Black Seas, allowing for easy access to international trade corridors.

- Mediterranean Region: Mersin (Where Mersin port is located), Antalya, and Adana-Yumurtalık Free Zones

- Aegean Region: Aegean (Izmir), Denizli, and Izmir Free Zones

- Marmara Region: Istanbul Atatürk Airport, Istanbul Industry and Trade, Istanbul Thracian, Europe, Kocaeli, Tübitak-Mam Technology, Bursa, and Sakarya İpekyolu Free Zones

- Black Sea Region: Trabzon, Rize, Samsun, and Filyos Free Zones

- Southeast Anatolian Region: Gaziantep, and Mardin Free Zones

- Central Anatolian Region: Kayseri Free Zoe

Tax Advantages for Turkish Free Zones

Free Zones in Turkey are a great opportunity for international investors and established companies.

- Customs and other ancillary charges are completely waived.

- Manufacturing businesses are free from corporate income tax at 100%.

- Value-added tax (VAT) and special consumption tax are completely excluded.

- Stamp duty is completely waived on all relevant papers.

- The real estate tax is completely free.

- Tax exemptions of 100 percent on income and corporation taxes for some logistic services offered in FZs, provided they are export-oriented.

- Employees’ earnings are tax-exempt to the full extent permitted by law (for companies that export at least 85 percent of the FOB value of the goods they produce in the FZs).

- Goods may stay in FZs indefinitely.

- Companies are permitted to transfer profits from FZs to other countries as well as to Turkey.

- Exemption from title deed costs for the acquisition and sale of real estate.

- VAT exemption is applicable throughout the construction, design, settlement, and approval stages.

- Infrastructure that is ready to use is free from VAT and other taxes.

- Permit for the importation of second-hand, used machinery.

The Economic Engine: Incentives for Growth and Success

In addition to tax exemptions, Turkey’s free zones offer a comprehensive package of economic incentives to support business growth:

- Zero-Tax Imports: Goods entering the free zones are exempt from customs duties, VAT, and other fees, making it easier and more cost-effective to import raw materials and equipment.

- Reduced Utility Costs: Infrastructure services like electricity, water, and telecommunications are VAT-exempt, further reducing operating costs for businesses.

- Unrestricted Financial Flow: Profits and earnings generated within the free zones can be freely transferred to Turkey or abroad, providing businesses with greater financial flexibility.

The Future of Turkish Free Zones

Turkey’s free zones are not just a temporary advantage; they are a long-term strategy for achieving sustained economic growth and international competitiveness. As the country continues to develop its infrastructure and improve its business environment, these zones are poised to become even more attractive for foreign investment and innovation.

By creating a welcoming environment for foreign businesses, Turkey’s free zones are strategically positioning the country as a global leader in trade, manufacturing, and technological advancements. As the world looks for new opportunities, Turkey’s free zones stand as islands of opportunity, ready to welcome businesses from around the globe.

Free zones in Turkey are one of the best places that you can start your business in Turkey in.

Turkey has been using the Free Zone model as a way to attract foreign investments and revitalize its economy. Free zones allow companies to invest in Turkey without having to comply with all the regulatory requirements of the country.